does binance send tax forms canada

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. If you find yourself in this situation reach out to Binances support team for a copy of your transaction history.

How To Buy Ethereum Uk In 2022 Beginners Guide

Consider the following scenario.

. All crypto assets earned by US. But remember - youll only pay tax on half your capital gain. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct.

Then I sent most of those coins to offline wallets leaving some on Binance to trade. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards. Now Ive been trading on Binance buying a bunch of alt coins Im interested in.

Any of your open social media accounts are. Tax return regardless of whether a Form 1099-MISC was issued. Capital losses may entitle you to a reduction in your tax bill.

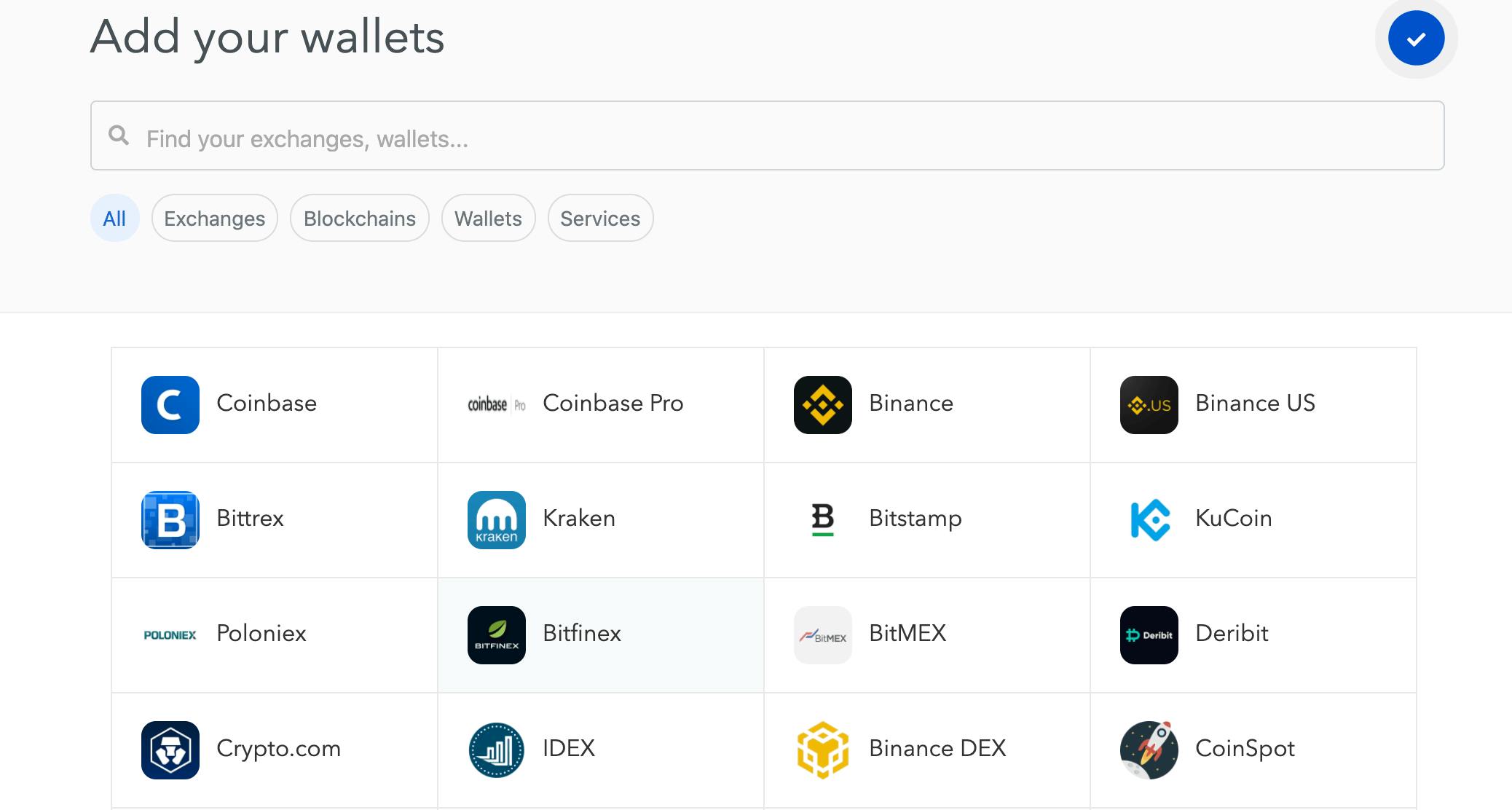

We explore what it offers pros and cons fees and more in our review. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Gateio is one of the largest cryptocurrency exchanges in the world and a top competitor to Binance.

Offers over 500 different cryptocurrencies and a wide selection of investment tools. The platform came to life in mid-January of 2019 some months after Binance opened a similar subsidiary for the African continent called Binance Uganda. Binance does not provide tax advice.

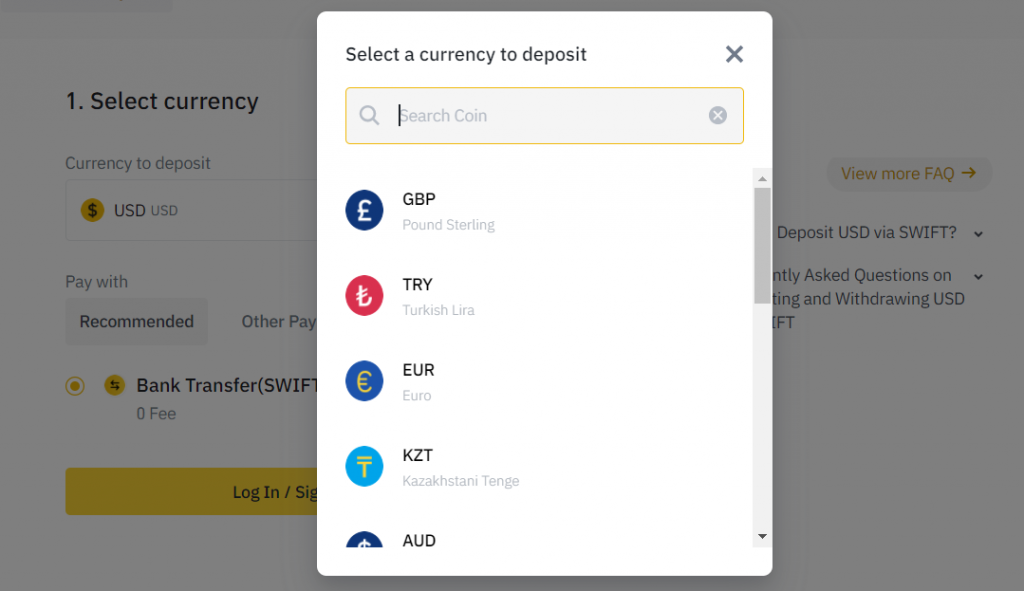

Unlike Binance it is available to both UK and US investors except those living in the states of New York and Washington. The API keys will automatically download your transaction history and keep your data in sync. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate.

Once it was on there I bought ETH with it then sent that ETH to my Binance account. See our full list of pros and cons below. Binance is one of the largest and most comprehensive cryptocurrency exchanges in the world.

What is a B-Notice and why did I receive one from the IRS. This transaction is considered a disposition and you have to report it on your income tax return. This video demonstrates how you can import your Binance trades into CryptoTraderTax to generate one-click tax reportsFor more information on doing your Bin.

Took about 10 minutes for the transaction to go through. Depending on the countrys tax framework when you trade commodities and the event produces capital gains or losses you may have to pay taxes. Income 2021 Income 2022 15.

Crypto assets can be earned on the Gemini exchange by lending assets through Earn or through bonuses or promotions. If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability. Yes Binance does provide tax info but you need to understand what this entails.

You have to convert the value of the cryptocurrency you received into Canadian dollars. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada.

Calculate and report your crypto tax for free now. International Customers At this time we do not provide tax forms for international customers. Buying goods and services with crypto.

Heres five ways the CRA may be watching you that you probably werent aware of. Like you I put CAD in QuadrigaCX. Report the resulting gain or loss as either business income or loss or a capital gain or loss.

You can see the Federal Income Tax rates for the 2021 and 2022 tax years below. And the IRS has enjoyed some public success in pursuing cryptocurrency users who evade tax. Back in the summer of 2018 the Canada Revenue Agency CRA promised to expose those who evade tax by using cryptocurrencies such as Bitcoin Litecoin Ethereum Dash Zcash and Ripple.

Cryptocurrency and tax evasion made headlines when on October 6 2020 the anti-virus software developer John McAfee was arrested in Spain for tax-evasion charges that he faced in the United States. If Roger is locked out of his account it will be impossible for him to gain access to his transaction history which he needs to accurately report his taxes. Persons are taxable and required to be reported on a US.

Canada Revenue Agency Makes Good on its Promise to Audit Bitcoin Cryptocurrency Investors Traders A Canadian Tax Lawyers Analysis. Let CryptoTraderTax import your data and automatically generate your gains losses and income tax reports. Here is a full review of Binance Jersey.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. Please utilize your transaction history to fulfil any local tax filing obligations. Connect CryptoTraderTax to your Binance account with the read-only API.

With Binance you are now able to have all your transactions tracked and accounted for automatically with our Tax Tool Functionality. BinanceUS makes it easy to review your transaction history. Gains and losses from cryptocurrency.

Binance does not provide tax or financial advice. This goes for ALL gains and lossesregardless if they are material or not. If this fails you should reach out.

Straightforward UI which you get your crypto taxes done in seconds at no cost. Depending on the countrys regulatory framework when you trade commodities and the event produces capital gains or losses you would have to pay taxes duly. Your tax forms will be ready soon.

We do not issue Form 1099-Bs. Plagued by regulatory legal disputes around the globe. Bitcoin Exchange Cryptocurrency Exchange Binance.

Binance Jersey is a subsidiary of Binance which allows European residents to perform fiat-to-crypto purchases of cryptocurrency.

Is It Possible To Convert My Bitcoin To Usd Using Binance Quora

0 Gas Fees Buying Busd Usdt For Binance In Canada Paytrie

Binance Vs Ftx Cryptovantage 2022

Binance To Cease Operations In Canada Amid New Regulations Cointribune

Coinbase Canada Review Apr 2022 A Subpar Crypto Exchange Yore Oyster

Binance Alternatives 2022 7 Platforms With Better Fees And Security

Learn How To Do Your 2021 Cryptocurrency Tax With Koinly Watch

0 Gas Fees Buying Busd Usdt For Binance In Canada Paytrie

Binance Trading Banned In Ontario Canada Effective Immediately Youtube

How To Find Your Transaction History On Binance For Taxes Followchain

Learn How To Do Your 2021 Cryptocurrency Tax With Koinly Watch

Binance Not Shutting Down For Ontario R Binance

5 Situations The Cra Will Tax Crypto Investors The Motley Fool Canada

Binance Trading Banned In Ontario Canada Effective Immediately Youtube

Make The Most Of Your Crypto Withdrawals With Binance Binance Blog

Binance Monthly Review July 2021 Building To The Moon Binance Blog

Binance Monthly Review July 2021 Building To The Moon Binance Blog

How To Find Your Transaction History On Binance For Taxes Followchain